UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934

Filed by the registrantx

Filed by a party other than the registrant¨

Check the appropriate box:

¨ Preliminary Proxy Statement | ¨ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e) (2)) | |

x Definitive Proxy Statement | ||

¨ Definitive Additional Materials | ||

¨ Soliciting Material Pursuant to Section 240.14a-12 |

General Dynamics Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of filing fee (check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Notice of Annual Meeting

and

Proxy Statement

2011

March 18, 2011

2014

Dear Fellow Shareholder:

You are invited to our Annual Meeting of Shareholders on Wednesday, May 4, 2011,7, 2014, at 9:00 a.m. local time. The meeting will be held at our headquarters located at 2941 Fairview Park Drive, Falls Church, Virginia. The principal items of business will be the election of directors;directors, an advisory vote on the selection of the company’s independent auditors; an advisory vote on executive compensation;auditors and an advisory vote on the frequency of future advisory votes onto approve executive compensation. Shareholders may raise other matters as described in the accompanying Proxy Statement.

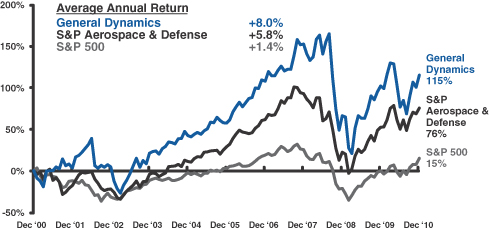

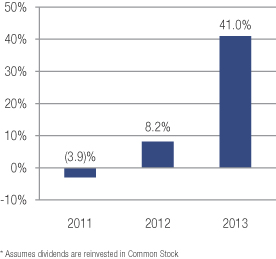

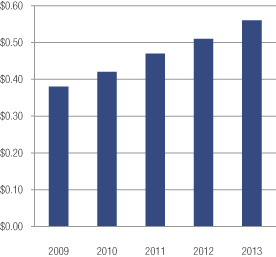

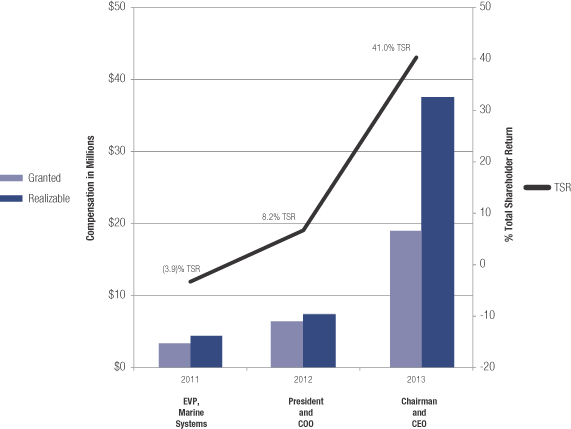

We have electedI am pleased to providereport that our company performed well in 2013. Our focus on operations led to strong financial results, particularly operating earnings, free cash flow and return on invested capital. Our strong performance and commitment to shareholders drove a 38% increase in our stock price. In 2013, we returned $1.3 billion of free cash flow to shareholders through dividends and share repurchases, not including the proxy materials forfirst quarter dividend payment that was accelerated and paid in December 2012. In early 2014, we underscored our 2011 annual meetingcommitment to most ofreturning value to our shareholders viaby repurchasing more than 11 million shares and obtaining authorization from our Board to repurchase an additional 20 million shares. Also in early 2014, our Board increased the Internet, as permitted byquarterly dividend to $0.62 per share (or 11%), the rules of the Securities and Exchange Commission. We believe this method of providing proxy materials will expedite receipt of proxy materials by many of our shareholders and lower the costs of our17th consecutive annual meeting. Additional information regarding proxy materials distribution is provided on page 2 of our proxy statement.increase.

Your vote is important.important. We encourage you to consider carefully the matters before us.

Sincerely,

Sincerely yours,

Phebe N. Novakovic

Jay L. Johnson

Chairman and Chief Executive Officer

2941 Fairview Park Drive, Suite 100

Falls Church, Virginia 22042-4513

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to Be Held on May 4, 20117, 2014

The Proxy Statement and 20102013 Annual Report are available atwww.generaldynamics.com/2011proxy.

www.generaldynamics.com/2014proxy

The Annual Meeting of Shareholders of General Dynamics Corporation, a Delaware corporation, will be held on Wednesday, May 4, 2011,7, 2014, at 9:00 a.m. local time at the General Dynamics Corporation headquarters located at 2941 Fairview Park Drive, Falls Church, Virginia. Proposals to be considered at the Annual Meeting include:

the election of 12 directors from the nominees named in the Proxy Statement (proposal 1);

an advisory vote on the selection of KPMG LLP, an independent registered public accounting firm, as the company’s independent auditors for 2014 (proposal 2);

an advisory vote to approve executive compensation (proposal 3);

two shareholder proposals as described in this Proxy Statement, provided they are presented properly at the meeting (proposals 4 and 5); and

the transaction of all other business that properly comes before the meeting or any adjournment or postponement of the meeting.

The Board of Directors unanimously recommends that you vote FOR proposals 1, 2 and 3.

The Board of Directors unanimously recommends for proposal 4 that you vote to hold future executive compensation advisory votes EVERY THREE YEARS.

The Board of Directors unanimously recommends that you vote AGAINST proposals 54 and 6.

5.

The Board of Directors set the close of business on March 7, 2011,6, 2014, as the record date for determining the shareholders entitled to receive notice of, and to vote at, the Annual Meeting. It is important that your shares be represented and voted at the meeting. Please complete, sign and return a proxy card, or use the telephone or Internet voting systems.

A copy of the 20102013 Annual Report is included withaccompanies this Notice and Proxy Statement and is available on the website listed above.

By Order of the Board of Directors,

Gregory S. Gallopoulos

Secretary

Falls Church, Virginia

March 18, 20112014

General Dynamics 2014 Proxy Statement

Proxy StatementTable of Contents

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 11 | ||||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 19 | ||||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| 34 | ||||

| 34 | ||||

| 41 | ||||

| 46 | ||||

| 50 | ||||

| 62 | ||||

| 63 | ||||

| 64 | ||||

| 65 | ||||

| 65 | ||||

| 66 | ||||

| 69 | ||||

| 72 | ||||

| 75 | ||||

March 18, 2011

General Dynamics 2014 Proxy Statement

PROXY STATEMENT

The Board of Directors of General Dynamics Corporation is soliciting your proxy for the Annual Meeting of Shareholders to be held on May 4, 2011,7, 2014, at 9:00 a.m. local time, or at any adjournment or postponement of the meeting. This Proxy Statement, and the accompanying Notice of Annual Meeting of Shareholders and proxy card, are being distributed on or about March 18, 2011,21, 2014, to holders of General Dynamics common stock, par value $1.00 per share (Common Stock). General Dynamics is a Delaware corporation.

Table of ContentsProxy Summary

This summary highlights selected information in this Proxy Statement. Please review the entire Proxy Statement and the General Dynamics 2013 Annual Report before voting.

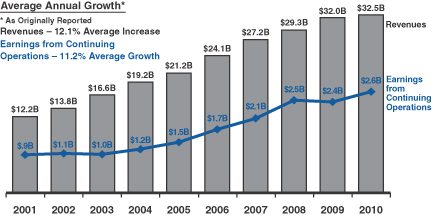

BUSINESS PERFORMANCE HIGHLIGHTS

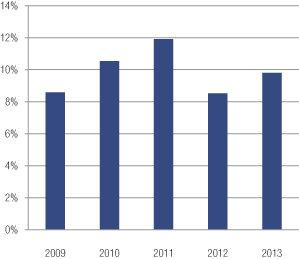

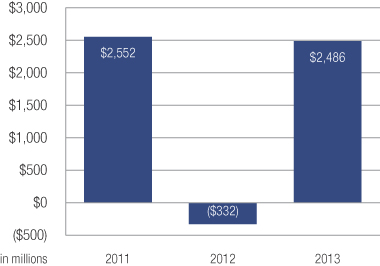

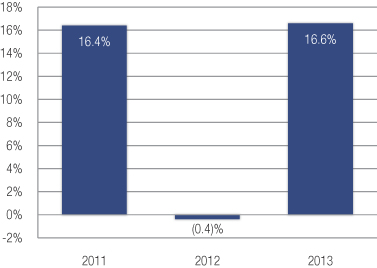

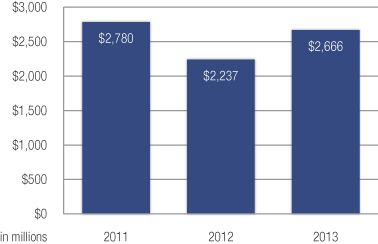

In 2013, we focused on operational excellence to expand margins, efficiently convert operating earnings into cash and increase return on invested capital. As a result, we achieved:

All shareholders of record at the close of business on March 7, 2011, are entitled to vote their shares of Common Stock at the Annual Meeting. On the record date, General Dynamics had 373,358,310 shares of Common Stock issued and outstanding.

Annual Meeting Attendance

Attending the Annual Meeting. All shareholders are welcome to attend the Annual Meeting. You will need an admission card or proof of ownership of Common Stock and personal photo identification for admission. If you hold shares directly in your name as a shareholder of record, you may obtain an admission card through the telephone or Internet voting systems or by marking the appropriate box on a proxy card. If your shares are held by a bank, broker or other holder of record (commonly referred to as registered in “street name”), you are considered a beneficial owner of those shares rather than a shareholder of record. In that case, you must present at the Annual Meeting proof of ownership of Common Stock, such as a bank or brokerage statement.

Quorum for the Transaction of Business. A quorum is the presence, in person or by proxy, of holders of a majority of the issued and outstanding shares of Common Stock as of the record date. If you submit a properly completed proxy in accordance with one of the voting procedures described below or appear at the Annual Meeting to vote in person, your shares of Common Stock will be considered present. For purposes of determining whether a quorum exists, abstentions and broker non-votes (as described below) will be counted as present. Once a quorum is present, voting on specific proposals may proceed. In the absence of a quorum, the Annual Meeting may be adjourned.

Proxy Materials Distribution

As permitted by the rules of the Securities and Exchange Commission (SEC), we are providing the proxy materials for our 2011 Annual Meeting via the Internet to most of our shareholders. For some shareholders, such as participants in our 401(k) plans, we are required to deliver proxy materials in hard copy. Nevertheless, we believe the use of the Internet will expedite receipt of the 2011 proxy materials by many of our shareholders and lower the costs of our Annual Meeting. On March 18, we initiated delivery of proxy materials to our shareholders of record one of two ways: (1) a notice containing instructions on how to access proxy materials via the Internet or (2) a printed copy of those materials. If you received a notice in lieu of a printed copy of the proxy materials, you will not automatically receive a printed copy of the proxy materials in the mail. Instead, the notice provides instructions on how to access the proxy materials on the Internet and how to vote online or by telephone. If you received such a notice, but would also like to receive a printed copy of the proxy materials, the notice includes instructions on how you may request a printed copy.

Voting

Voting Procedures. You must be a shareholder of record on the record date to vote your shares at the Annual Meeting. Each shareholder of record is entitled to one vote on all matters presented at the Annual Meeting for each share of Common Stock held. You are considered a shareholder of record if your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A. (Computershare), as of the record date. If you are a shareholder of record, Computershare provides proxy materials to you on our behalf. If your shares are registered in different names or held in more than one account, you may receive more than one proxy card or set of voting

instructions. In that case, you will need to vote separately for each set of shares in accordance with the voting procedures outlined below.

Shareholders of record may cast their vote by:

The telephone and Internet voting systems are available 24 hours a day. They will close at 11:59 p.m. Eastern Time on May 3, 2011.Please note that the voting deadline differs for participants in our 401(k) plans, as described below. All shares represented by properly executed, completed and unrevoked proxies that are received on time will be voted at the Annual Meeting in accordance with the specifications made in the proxy card. If you return a proxy card but do not specifically direct the voting of shares, your proxy will be voted as follows:

If your shares are held by a bank, broker or other holder of record, you are the beneficial owner of those shares rather than the shareholder of record. If you are a beneficial owner, your bank, broker or other holder of record will forward the proxy materials to you. As a beneficial owner, you have the right to direct the voting of your shares by following the voting instructions provided with these proxy materials. Please refer to the proxy materials forwarded by your bank, broker or other holder of record to see if the voting options described above are available to you.

The Northern Trust Company (Northern Trust) is the holder of record of the shares of Common Stock held in our 401(k) plans – the General Dynamics Corporation Savings and Stock Investment Plans and the General Dynamics Corporation Savings and Stock Investment Plan for Represented Employees. If you are a participant in one of these plans, you are the beneficial owner of the shares of Common Stock credited to your plan account. As beneficial owner and named fiduciary, you have the right to instruct Northern Trust, as plan trustee, how to vote your shares. In the absence of timely voting instructions, Northern Trust has the right to vote shares at its discretion.

Computershare provides proxy materials to participants in these plans on behalf of Northern Trust. If you are a plan participant and a shareholder of record, Computershare may combine the shares registered directly in your name and the shares credited to your 401(k) plan account onto one proxy card. If Computershare does not combine your shares, you will receive more than one set of proxy

materials. In that case, you will need to submit a vote for each set of shares. The vote you submit via proxy card or the telephone or Internet voting systems will serve as your voting instructions to Northern Trust.To allow sufficient time for Northern Trust to vote your 401(k) plan shares, your vote, or any re-vote as described below, must be received by 9 a.m. Eastern Time on May 2, 2011.

Revoking a Proxy. A shareholder of record may revoke a proxy at any time before it is voted at the Annual Meeting by:

Our Corporate Secretary must receive notice of revocation, or a subsequent proxy card, before the vote at the Annual Meeting for a revocation to be valid. Except as described above for participants in our 401(k) plans, a re-vote by the telephone or Internet voting systems must occur before 11:59 p.m. Eastern Time on May 3, 2011. If you are a beneficial owner, you must revoke your proxy through the appropriate bank, broker or other holder of record.

Vote Required

Broker Non-Vote. A broker non-vote occurs when a bank, broker or other holder of record holding shares for a beneficial owner does not vote on a particular proposal because that holder does not have discretionary voting power for the proposal and has not received voting instructions from the beneficial owner. Banks, brokers and other holders of record have discretionary authority to vote shares without instructions from beneficial owners only on matters considered “routine” by the New York Stock Exchange, such as the advisory vote on the selection of the independent auditors. On non-routine matters, such as the election of directors, executive compensation matters and the shareholder proposals, these banks, brokers and other holders of record do not have discretion to vote uninstructed shares and thus are not “entitled to vote” on such proposals, resulting in a broker non-vote for those shares.We encourage all shareholders that hold shares through a bank, broker or other holder of record to provide voting instructions to such parties to ensure that their shares are voted at the Annual Meeting.

Proposal 1 – Election of the Board of Directors of the Company.Directors will be elected by a majority of the votes cast and entitled to vote at the Annual Meeting. A “majority of the votes cast” means that the number of votes cast “for” a director’s election exceeds the number of votes cast “against” that director’s election. You may vote for, vote against or abstain from voting for any or all nominees. Abstentions and broker non-votes will not be counted as a vote cast “for” or “against” a director’s election.

Proposal 2 – Selection of Independent Auditors.This proposal requires an affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote at the Annual Meeting to be approved. You may vote for, vote against or abstain from voting on this matter. Abstentions will have the effect of a vote against this proposal.

Proposal 3 – Advisory Vote on Executive Compensation. This proposal requires an affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote at the Annual Meeting to be approved. You may vote for, vote against or abstain from voting on this matter. Abstentions will have the effect of a vote against this proposal.

Proposal 4 – Advisory Vote on the Frequency of Future Executive Compensation Advisory Votes. For this proposal, you may choose to express a preference for holding future advisory votes on executive compensation every year, every two years or every three years. For any particular frequency to be approved, it must receive an affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote at the Annual Meeting. You may choose instead to abstain from voting on this matter. Abstentions will have the effect of a vote against each choice.

Proposals 5 and 6 – Shareholder Proposals. Proposals 5 and 6 each require an affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote on the proposal to be approved. You may vote for, vote against or abstain from voting on these matters. Abstentions will have the effect of a vote against the proposals.

Voting Tabulation. Representatives of American Election Services, LLC, will tabulate the vote at the Annual Meeting.

Proxy Solicitation. The Board of Directors is soliciting proxies from shareholders. Directors, officers and other employees of General Dynamics may solicit proxies from our shareholders by mail, e-mail, telephone, facsimile or in person. In addition, Innisfree M&A Incorporated (Innisfree), 501 Madison Avenue, New York, New York, is soliciting brokerage firms, dealers, banks, voting trustees and their nominees.

We will pay Innisfree approximately $15,000 for soliciting proxies for the Annual Meeting and will reimburse brokerage firms, dealers, banks, voting trustees, their nominees and other record holders for their out-of-pocket expenses in forwarding proxy materials to the beneficial owners of Common Stock. We will not provide compensation, other than their usual compensation, to our directors, officers and other employees who solicit proxies.

Election of the Board of Directors of the Company

(Proposal 1)

This year, 11 nominees are standing for election to the Board of Directors. Each nominee elected as a director will hold office until:

In the event that any nominee withdraws or for any reason is unable to serve as a director, your proxy will be voted for any remaining nominees (except as otherwise indicated in your proxy) and any replacement nominee designated by the Nominating and Corporate Governance Committee of the Board of Directors.

11.8% |

| ||||

Ms. Barra’s business and educational background, including a bachelors degree in electrical engineering and a masters degree in business administration, enable her to provide valuable strategic, operational and business advice to the company. Ms. Barra’s current position with General Motors as senior vice president, global product development, and her former positions as vice president, global human resources, and vice president, global manufacturing engineering, position her well to advise our businesses on a broad range of matters in the areas of human resources, engineering, manufacturing, and research and development. Her strong and diversified business background provides her with a deep understanding of the challenges facing large public companies with complex global operations.

$ 2.7 Billion |

| |||||

Mr. Chabraja’s 15 years of service as a senior executive officer and 12-year tenure as chairman and chief executive officer of our company make him an experienced and trusted advisor. He has in-depth knowledge of all aspects of General Dynamics and a deep understanding and appreciation of our customers, business operations and approach to risk management. His service at General Dynamics combined with his service on other public company boards provides him with a valuable perspective on governance and management matters that face large public companies.

16.6% |

| |||||

As the longest-serving member of our board and a significant shareholder, Mr. Crown has an abundance of knowledge regarding General Dynamics and its history. As president of Henry Crown and Company, a private investment firm with diversified interests, Mr. Crown has broad experience in general business management and capital deployment strategies. His many years of service as a director of our company and two other large public companies have provided him with a deep understanding of the roles and responsibilities of a board of a large public company.

|

| |

Mr. Fricks’ prior senior executive positions at Newport News Shipbuilding Inc., including chairman and chief executive officer, president and chief executive officer, vice president-finance, controller and treasurer, give him critical knowledgeTo achieve these results, our management strengthened performance by continuously improving the operations of the management, financial and operational requirements of a large company and a keen understandingeach of our key customers. In these positions, Mr. Fricks gained extensive experience in dealing with accounting principles and financial reporting, evaluating financial results andbusinesses. Among our highlights for the financial reporting process of a large company. Based on this experience, the Board has determined that Mr. Fricks is an Audit Committee Financial Expert.year:

|

| |

Our Aerospace group continued to increase production of its newest aircraft models, the Gulfstream G650 and G280, and experienced healthy demand across all models. Overall, the group enjoyed increased revenues, operating earnings and operating margins over 2012.

Our Combat Systems and Information Systems and Technology business groups managed the challenges arising from budget and spending pressures on the groups’ primary customer, the U.S. Army. These efforts produced strong operating earnings. Our Combat Systems group also pursued significant international orders throughout the year, resulting in an early 2014 award that will contribute significantly to the company’s backlog for the next several years.

Our Marine Systems group continued its work on key U.S. Navy programs, as well as increasing its ship engineering, repair and other services. Also, commercial ship construction began for Jones Act ships secured in late 2012 and 2013. The group received significant Navy and commercial orders that will support backlog for several years.

Across the company, we reduced costs in a disciplined, prudent manner to position our portfolio to remain competitive in a challenging environment. Examples of our initiatives include consolidating businesses, divesting non-core assets, putting troubled programs on the path to success and reducing costs at our corporate headquarters.

Prior to joining General Dynamics in September 2008, Mr. Johnson served as both chief executive officer of large gas and electric utility businesses and as an Admiral in the U.S. Navy. He served as a director of General Dynamics for six years before becoming an executive officer of the company. Mr. Johnson rose through the ranks of the U.S. Navy to become Chief of Naval Operations and a member of the Joint Chiefs of Staff. Mr. Johnson’s superior business acumen, knowledge of all aspects of the company’s business and history, and prior military experience position him well to serve as our chairman and chief executive officer.2014 Proxy Statement 1

|

| |

Proxy Summary

Mr. Joulwan had a distinguished career in the U.S. Army prior to joining our Board in 1998. As a General, Mr. Joulwan served as Commander-in-Chief of the Southern Command and the European Command and as the 11thSupreme Allied Commander, Europe. Mr. Joulwan’s unique perspective on U.S. and foreign military strategy and operations, including NATO operations, provides him with valuable insight into international defense markets and the global defense industry. Mr. Joulwan’s demonstrated leadership and management skills make him a valuable strategic advisor to our aerospace and defense businesses.

|

| |

Dr. Kaminski’s prior service as the Under Secretary of Defense for Acquisition and Technology provides him with valuable insight into research and development, procurement, acquisition reform and logistics at the U.S. Department of Defense. In addition, Dr. Kaminski’s education and business background in advanced technology, including dual master’s degrees in aeronautics-astronautics and electrical engineering and a doctorate in aeronautics and astronautics, enable him to provide valuable strategic and business advice to our aerospace and defense businesses.

|

| |

Prior to retiring from the U.S. Army at the rank of General, Mr. Keane served as Vice Chief of Staff of the Army. As a senior officer, Mr. Keane managed significant operating budgets and addressed complex operational and strategic issues. Mr. Keane’s astute appreciation for the complexities of the U.S. military and the defense industry combined with his demonstrated leadership and management skills make him a valuable strategic advisor to our aerospace and defense businesses. Mr. Keane also has gained a strong understanding of public company governance and operations through his service on three public company boards.

|

| |

Prior to retiring from the U.S. Air Force at the rank of General, Mr. Lyles served as Commander of the Air Force Materiel Command and Vice Chief of Staff of the U.S. Air Force. In these positions, Mr. Lyles managed significant operating budgets and addressed complex operational issues. The broad knowledge of the U.S. military and the defense industry he attained through these experiences, combined with his engineering and aerospace educational background, enable Mr. Lyles to provide critical strategic and business advice to our aerospace and defense businesses. In addition, Mr. Lyles has gained a thorough understanding of the challenges that face public companies through his service on several public company boards.

|

| |

Mr. Osborn’s prior service as a senior executive of Northern Trust Corporation, including as chairman and chief executive officer, president and chief operating officer, provides him with extensive knowledge of the complex financial, operational and governance issues of a large public company. He brings to our board a well-developed awareness of financial strategy and asset management and a strong understanding of public company governance. The Board has determined that Mr. Osborn’s extensive experience with accounting principles, financial reporting and evaluation of financial results qualifies him as an Audit Committee Financial Expert.

|

| |

Mr. Walmsley’s prior service as Chief of Defence Procurement for the United Kingdom Ministry of Defence gives him acute comprehension of international defense matters. Moreover, his service as a Vice Admiral in the Royal Navy and his appointments as Controller, Chairman of the Naval Nuclear Technical Safety Panel and Director General, Submarines, provide him with an important perspective on our aerospace and defense businesses. Mr. Walmsley’s service as a public company director in the United States and the United Kingdom positions him well to understand complex operational and governance matters at a large public company.

Your Board of Directors unanimously recommends a vote FOR all the director nominees listed above.

Governance of the CompanyCORPORATE GOVERNANCE HIGHLIGHTS

Board of Directors

The Board of Directors oversees General Dynamics’ business and affairs pursuant to the General Corporation Law of the State of Delaware and our Certificate of Incorporation and Bylaws. The Board is the ultimate decision-making body, except on matters reserved for the shareholders.

Corporate Governance Guidelines

Our Board of Directors believes that a commitment to good corporate governance enhances shareholder value. To that end, on the recommendation of the Nominating and Corporate Governance Committee, the Board has adoptedOur governance policies and procedures to ensure effective governance of both the Board and the company. The policies and procedures are stated in the General Dynamics Corporate Governance Guidelines, available on our website atwww.generaldynamics.com, under the “Investor Relations – Corporate Governance” captions, or in print upon request. The Board regularly reviews these guidelines and updates them periodically in response to changing regulatory requirements and evolving best practices.

Codes of Ethics

Since the inception of a formal ethics program in 1985, our Board of Directors and management have devoted significant time and resources to maintaining an active and robust ethics program. Since 1985, we have had a Standards of Business Ethics and Conduct Handbook that applies to all employees. This handbook, known as the “Blue Book,” has been updated and improved as we have grown and changed over the years. Our ethics program also includes a 24-hour ethics helpline, which employees can call to communicate any business ethics-related concerns, and periodic training on ethics and compliance topics for all employees.

We also have adopted ethics codes specifically applicable to our financial professionals and our Board of Directors. The Code of Ethics for Financial Professionals, which supplements the Blue Book, applies to our chief executive officer, chief financial officer, controller and any person performing similar financial functions. In addition, there is a Code of Conduct for Members of the Board of Directors that embodies our Board’s commitment to manage our business in accordance with the highest standards of ethical conduct.

Copies of the Standards of Business Ethics and Conduct Handbook, Code of Ethics and Code of Conduct are available on our website atwww.generaldynamics.com, under the “Investor Relations – Corporate Governance” captions, or in print upon request. We will disclose on our website any amendments to or waivers from the Standards of Business Ethics and Conduct, Code of Ethics or Code of Conduct on behalf of any of our executive officers, financial professionals or directors.

Related Person Transactions Policy

Our Board of Directors has adopted a written policy on the review and approval of related person transactions. Related persons covered by the policy are:

A related person transaction is defined by this policy as a transaction, arrangement or relationship (or any series of similar transactions, arrangements or relationships) in which: (1) General Dynamics will be a participant; (2) the amount involved exceeds $120,000; and (3) any related person will have a direct or indirect material interest. The following interests and transactions are not subject to the policy:

The Nominating and Corporate Governance Committee is responsible for reviewing, approving and, where applicable, ratifying related person transactions. If a member of the committee has an interest in a related person transaction, then he or she will not be part of the review process.

In considering the appropriate action to be taken regarding a related person transaction, the committee or the Board (as the case may be) will consider the best interests of General Dynamics and whether the transaction is fair to the company, is on terms that would be obtainable in an arms-length transaction and serves a compelling business reason, and any other factors it deems relevant. As a condition to approving or ratifying any related person transaction, the committee or the Board may impose whatever conditions and standards it deems appropriate, including periodic monitoring of ongoing transactions.

The following transaction with a related person was determined to pose no actual conflict of interest and was approved by the committee pursuant to our related person transactions policy:

In January 2010, Nicholas D. Chabraja entered an agreement to purchase a mid-sized pre-owned aircraft from Gulfstream Aerospace Corporation, a subsidiary of General Dynamics, for a price of approximately $8,500,000. The purchase was completed in the first quarter of 2010. The terms and conditions of the sales agreement were negotiated in an arms-length transaction and represent standard terms and conditions for a pre-owned aircraft sale.

Director Independence

Our Board of Directors assesses the independence of our directors and examines the nature and extent of any relationships between General Dynamics and our directors, their families and their affiliates. For a director to be considered independent, the Board must determine that a director does not have any direct or indirect material relationship with General Dynamics. Our Board has established director independence guidelines (the Director Independence Guidelines) as part of the Corporate Governance Guidelines to assist in determining director independence in accordance with the rules of the New York Stock Exchange. The Director Independence Guidelines provide that an “independent director”:

For purposes of the Director Independence Guidelines, references to General Dynamics include any of our subsidiaries and the term “immediate family member” includes a person’s spouse, parents, children, siblings, mothers- and fathers-in-law, sons- and daughters-in-law, brothers- and sisters-in-law, and anyone (other than domestic employees) who shares the person’s home.

In March 2011, the Board of Directors considered whether each member of the Board meets the definition of an “independent director” in accordance with the rules of the New York Stock Exchange and the Director Independence Guidelines. The Board determined that Mary T. Barra, James S. Crown, William P. Fricks, George A. Joulwan, Paul G. Kaminski, John M. Keane, Lester L. Lyles, William A. Osborn and Robert Walmsley each qualifies as an independent director. The Board also determined that Nicholas D. Chabraja and Jay L. Johnson are not independent directors due to Mr. Chabraja’s recent service as chief executive officer and Mr. Johnson’s current service as chief executive officer. To make these independence determinations, the Board reviewed all relationships between General Dynamics and the directors and affirmatively determined that none of the directors who qualifies as independent has a material business, financial or other type of relationship with General Dynamics

(other than as a director or shareholder of the company). Specifically, the Board considered the following relationships and found them to be immaterial for the reasons discussed below:

Ms. Barra and Messrs. Crown, Joulwan, Kaminski, Keane, Lyles and Osborn serve as members of the boards of charitable and other non-profit organizations to which General Dynamics has made payments or contributions in the usual course of our business and annual giving programs. All payments or contributions by General Dynamics were below the greater of $1 million or 2 percent of the organizations’ gross revenues.

Messrs. Crown, Joulwan, Kaminski, Keane, Lyles, Osborn and Walmsley serve as directors of companies, Mr. Walmsley serves as a consultant to companies and Ms. Barra is an executive officer of a company, to which we sell products and services, or from which we purchase products and services, in the ordinary course of business. None of the directors had any material interest in, or received any special compensation in connection with, these ordinary-course business relationships.

Board Leadership Structure

Our Board elects a chairman from among the directors and determines whether to separate or combine the roles of chairman and chief executive officer based on what it believes best serves the needs of the company and its shareholders at any particular time. In July 2009, the Board separated the roles to facilitate the seamless transition of the chief executive officer position from Mr. Chabraja to Mr. Johnson. In May 2010, the Board determined that it was in the best interests of the company and its shareholders to recombine the roles of chairman and chief executive officer, at which point Mr. Johnson began serving as the chairman and chief executive officer. The Board believes that Mr. Johnson’s in-depth knowledge and keen understanding of the company’s operations and risk management practices position him to provide strong and effective leadership to the Board and to ensure that the Board is informed of important issues facing the company. The Board also believes that having a combined role promotes a cohesive, strong and consistent vision and strategy for the company.

In February 2010 the Board created the position of a lead director. The lead director will be selected annually by the Board from among the independent directors. Mr. Crown was selected as lead director effective May 2010. The Board believes that the lead director position provides additional independent oversight of senior management and board matters. The selection of a lead director is meant to facilitate, and not to inhibit, communication among the directors or between any of them and the chairman. Accordingly, directors are encouraged to continue to communicate among themselves and directly with the chairman.

The lead director’s authority and responsibilities are as follows:

Risk Oversight

We believe the Board leadership structure described above supports a risk-management process in which senior management is responsible for our company’s day-to-day risk-management processes and the Board provides oversight of those processes. To fulfill this responsibility, the Board oversees risk management at both the full Board and committee levels.

The full Board reviews and approves annually a corporate policy addressing the delegation of authority and assignment of responsibility to ensure that the responsibilities and authority delegated to senior management are appropriate from an operational and risk-management perspective. In addition, the Board assesses the company’s strategic and operational risks throughout the year, with particular focus on these risks at an annual three-day Board meeting in early February. At this meeting, senior management reports on the opportunities and risks faced by the company in the markets in which the company conducts business. Additionally, each business unit president and each business group executive vice president presents the unit’s and group’s respective operating plan and strategic initiatives for the year. The Board reviews, adjusts where appropriate, and approves the business unit and business group goals and adopts our company operating plan for the year. These plans and related risks are then monitored throughout the year as part of periodic financial and performance reports given to the Board by the chief financial officer and executive vice presidents of each business group.

In addition, the Audit Committee has responsibility for oversight of the company’s policies and practices concerning risk assessment and risk management. The committee reviews and takes appropriate action with respect to the company’s annual and quarterly financial statements, the internal audit program, the ethics program and disclosures made with respect to the company’s internal controls. To facilitate these risk oversight responsibilities, the committee receives regular briefings from members of senior management on the internal audit plan; Sarbanes-Oxley 404 compliance; significant litigation; ethics program matters; and health, safety and environmental matters. The committee also holds regular executive sessions with the staff vice president, internal audit, and an executive session with the partners of the KPMG LLP audit team.

In addition to the Audit Committee’s role in risk oversight, each of the other Board committees considers risk as it relates to its particular areas of responsibility. The Finance and Benefit Plans Committee oversees the management of the company’s finance policies and the assets of the company’s employee benefit plans. To assess risks in these areas, the committee receives regular briefings from our vice president and treasurer, and chief financial officer, on finance policies and asset performance. The Compensation Committee oversees and administers our incentive and equity compensation programs to ensure that the programs create incentives for strong operational performance and for the long-term benefit of the company and its shareholders. The committee receives regular briefings from the chairman and chief executive officer and the senior vice president, human resources and administration, on compensation matters. Finally, the Nominating and Corporate Governance Committee oversees risks related to board composition and governance matters and receives regular briefings from the senior vice president, general counsel and secretary.

Board Meetings and Attendance

During 2010, the Board of Directors held nine meetings. This included a three-day meeting in February to review our 2010 operating plan, including the operating plan of each of our business units and business groups. In April 2010, the Board visited the Basel, Switzerland facility of our Jet Aviation subsidiary and met with Jet Aviation’s management. Each of our directors attended at least 90 percent

of the meetings of the Board and committees on which they served in 2010. We encourage directors to attend each meeting of shareholders. All of our directors at the time attended the 2010 annual meeting of shareholders.

Executive Sessions of the Board

Our Board holds executive sessions of the non-management directors in conjunction with all regularly scheduled Board meetings. The non-management directors may also meet without management present at other times as desired by any non-management director. In addition, the independent directors meet in executive session at least once a year. The lead director serves as chair at the executive sessions.

Board Committees

The Board of Directors has four standing committees, described below. Currently, three of the four Board committees are composed of independent, non-management directors, including those committees that are required by the rules of the New York Stock Exchange to be composed solely of independent directors. Each of the Board committees has a written charter. Copies of these charters are available on our website atwww.generaldynamics.com, under the “Investor Relations – Corporate Governance” captions, or in print upon request.

Committee Members. Listed below are the members of each of the four standing committees as of March 7, 2011, with the chair appearing first.include:

| Governance Practice | For more information | |||||

|

|

|

| |||

| p. 46 | |||||

| p. 46 | |||||

| p. 10 | |||||

| p. 10 | |||||

| p. 74 | |||||

| p. 11 | |||||

| p. 11 | |||||

| Corporate Governance Guidelines * | |||||

Ourrelated person transactions policy ensures appropriate Board review of related person transactions. | p. 15 | |||||

Ouractive and robust ethics program includes strong Codes of Ethics for all employees, with specific codes for our financial professionals and directors. | p. 9 www.generaldynamics.com – | |||||

Asustainability report discusses our commitment to our stakeholders and communities. | www.generaldynamics.com – “Investor Relations” – “Corporate Sustainability” | |||||

Disclosure of ourcorporate political contributions and ourtrade association dues describes the process and oversight we employ in each area. | www.generaldynamics.com – “Investor Relations” – “Political Contributions” and “Trade Associations” | |||||

Aclawback policy under which executive compensation is recouped in the event of fraudor intentional illegal conduct that results in a financial restatement. | p.46 | |||||

A strong affirmation of our corporate commitment to honoring and protectinghuman dignity. | www.generaldynamics.com – “Investor Relations” | |||||

Our shareholders have the right to request aspecial meeting of shareholders. | Bylaws** | |||||

We do not have ashareholder rights plan, or poison pill; any future rights plan must be submitted to shareholders. | Corporate Governance Guidelines * |

| * | Our Corporate Governance Guidelines are available on our website at www.generaldynamics.com under the “Investor Relations” heading. |

| ** | Our Bylaws are available on our website at www.generaldynamics.com under the “Investor Relations” – “Highlights” headings. |

Audit Committee. This committee provides oversight on accounting, financial reporting, internal control, auditing and regulatory compliance activities. It selects and evaluates our independent auditors and evaluates their independence. In addition, this committee reviews our audited consolidated financial statements with management and the independent auditors, recommends to the Board whether the audited consolidated financial statements should be included in our annual report on Form 10-K and prepares a report to shareholders that is included in our proxy statement. This committee also evaluates the performance, responsibilities, budget and staffing of the internal audit function, as well as the scope of the internal audit plan. This committee held 11 meetings in 2010. The Board of Directors has determined that Mr. Fricks, the chair of the Audit Committee, and Mr. Osborn each qualifies as an “audit committee financial expert” as defined by the SEC.2 General Dynamics 2014 Proxy Statement

Proxy Summary

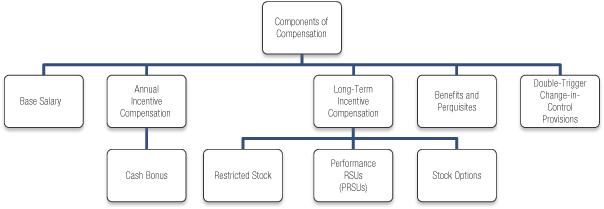

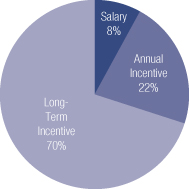

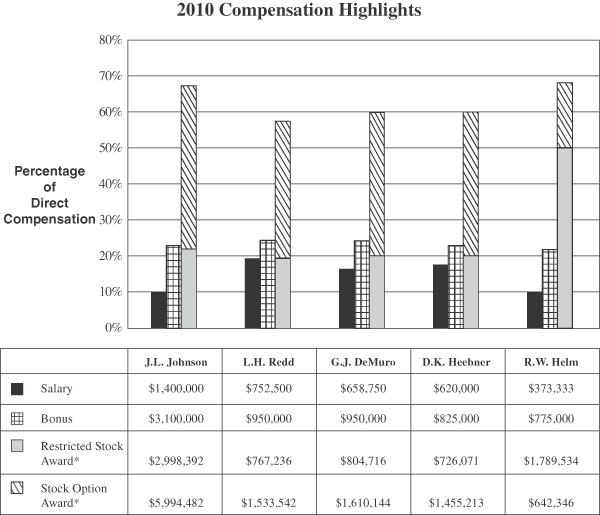

Compensation Committee. EXECUTIVE COMPENSATION HIGHLIGHTSThis committee evaluates the

Our compensation philosophy at General Dynamics is to align each Named Executive Officer’s compensation with company, business group and individual performance, of the chief executive officer and other officers and reviews and approves their compensation. The processes and procedures for the review and approval of executive compensation are described in the Compensation Discussion and Analysis section of this Proxy Statement. In addition, this committee has responsibility for recommending to the Board the level and form of compensation and benefits for directors. It also administers our incentive compensation plans and reviews and monitors succession plans for the chief executive officer and other officers. This committee held five meetings in 2010.

Consistent with its obligations and responsibilities, the Compensation Committee may form subcommittees of one or more members of the committee and delegate its authority to the subcommittees as it deems appropriate. In addition, the committee has the authority to retain and terminate external advisors in connection with the discharge of its duties. The committee’s charter also provides that the committee has sole authority to approve consultant fees (to be funded by the company) and the terms of the consultant’s retention. Pursuant to the charter, the Compensation Committee has, from time to time, engaged PricewaterhouseCoopers LLP (PwC) as a compensation consultant to provide advice on executive compensation matters.the incentives necessary to attract, motivate and retain the executives that help drive the company’s success. In 2010, the committee, after reviewing fees paid by the companyorder to PwC for other services and considering PwC’s independence generally, engaged PwC to provide context on the current executive compensation landscape from the perspective of regulators, shareholders and the competitive market, and to conduct a review of our executive compensation processes. PwC is also available to provide advice to the chairman of the Compensation Committee or the Compensation Committee as a whole on executive compensation matters on an as-needed basis. PwC does not, however, regularly attend Compensation Committee meetings or make any specific recommendations on the amount or form of compensation for any of our executives.

In 2010, the chairman of the Compensation Committee approved fees of approximately $17,000 to PwC in its capacity as external advisor to the Compensation Committee. Management neither made, nor recommended, the decision to engage PwC. The PwC group providing compensation services to the Compensation Committee reports directly to the chairman ofachieve these goals, the Compensation Committee and is not involvedmanagement team:

Position base salary at approximately the median of our peer companies;

Align annual incentive awards with key annual financial, operating and strategic objectives based on our earnings from continuing operations, free cash flow from operations, sales, as well as business group performance; and

Align long-term incentive awards with our shareholders’ interests by basing the awards on return on invested capital and indexing the target amount to total annual cash compensation. Long-term incentives are directly linked to stock performance through restricted stock and stock options. Our long-term incentives are part of a program that encourages stock ownership along with one of the most robust stock ownership guidelines in providing any other servicesbusiness.

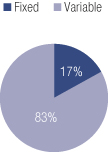

In summary, we compensate our Named Executive Officers as follows:

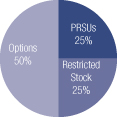

| Component of Compensation | Form of Compensation | |

| Long-Term Incentive Compensation | Performance Restricted Stock Units (25% of total annual grant value) Restricted Stock (25% of total annual grant value) Stock Options (50% of total annual grant value) | |

| Annual Cash Incentive | Annual Performance-Based Cash Bonus | |

| Base Salary | Annual Cash Salary | |

| Retirement | 401(k) Plan Defined Benefit Retirement Plan Supplemental Retirement Plan Supplemental Savings Plan | |

| Other | Limited Perquisites |

VOTING MATTERSAND BOARD RECOMMENDATIONS

At this year’s Annual Meeting, we are asking our shareholders to vote on the company. During 2010, we also retained PwC to provide servicesfollowing matters:

| Proposal | Board Recommendation | |

Proposal 1: Election of Directors | The Board recommends a voteFOR the election of the director nominees named in this Proxy Statement. See pages 4 through 8 for more information on the nominees. | |

Proposal 2: Selection of Independent Auditors | The Board recommends a voteFOR this proposal. See page 19 for details. | |

Proposal 3: Advisory Vote to Approve Executive Compensation | The Board recommends a voteFOR this proposal. See page 22 for details. | |

Proposal 4: Shareholder Proposal – Independent Board Chairman | The Board recommends a voteAGAINST this proposal. See pages 66 through 68 for details. | |

Proposal 5: Shareholder Proposal – Lobbying Disclosure | The Board recommends a voteAGAINST this proposal. See pages 69 through 71 for details. |

Important information about the company unrelated to executive compensation including tax, accounting support, executive financial planningAnnual Meeting and other business-related services. The aggregate fees paid for those services in 2010 were approximately $2,570,000.voting can be found beginning on page 72.

Finance and Benefit Plans Committee. This committee oversees the management of the finance policies of General Dynamics and the assets of our employee benefit plans (other than multiemployer plans). This committee held three meetings in 2010.2014 Proxy Statement 3

ELECTIONOFTHE BOARDOF DIRECTORSOFTHE COMPANY

Nominating(PROPOSAL 1)

Director Nominations and Corporate Governance Committee. This committee evaluates board and management effectiveness; advises the Board on corporate governance matters; monitors developments, trends and best practices in corporate governance; and recommends corporate governance guidelines that comply with legal and regulatory requirements. It also identifies qualified individuals to serve asCriteria. General Dynamics’ directors and recommends the director nominees proposed either for electionare elected at theeach annual meeting of shareholders and hold office for one-year terms or to fill vacanciesuntil successors are elected and newly created directorships between annual meetings. This committee held six meetings in 2010.

Director Nominations

qualified. The Nominating and Corporate Governance Committee considers director nominees from various sources. The committee considerssources and makes recommendations to the Board concerning the appropriate size and composition of the Board, including the relevant characteristics and experience required of new members. Nominees are chosenchooses nominees with the primary goal of ensuring that the entire Board collectively serves the interests of shareholders based on the attributes, experience, qualifications and skills noted below.shareholders. In assessing director candidates, the Nominating and Corporate Governance Committeecommittee considers the background and professional experience of the candidates in the context of the current Board composition to ensure there is a diverse range of backgrounds, talent, skill and expertise among the directors.expertise. Relevant criteria considered by the committee include: business and financial expertise, technical expertise and familiarity with the issues affecting aerospace and defense

businesses. The committee also carefully considers any potential conflicts of interest. All nominees must possess good judgment, an inquiring and independent mind, and a reputation for the highest personal and professional ethics, integrity and values. Nominees must be willing to devote sufficient time and effort to carrying out their duties and responsibilities and should be committed to serve on the Board for an extended period of time.

Each year the directors undertake a self-assessment that elicits feedback on the performance and effectiveness of the Board and each committee. As part of this self-assessment, the directors are asked to consider whether, among other things, the current directors possess the appropriate mix of skills, experience and diverse viewpoints to enable the Board to function effectively. The results of the self-assessment are presented to the Nominating and Corporate Governance Committee and the full Board.

The Nominating and Corporate Governance Committee will consider director nominees recommended by shareholders. To recommend a qualified person to serve on the Board of Directors, a shareholder should write to the Corporate Secretary, General Dynamics Corporation, 2941 Fairview Park Drive, Suite 100, Falls Church, Virginia 22042. The written recommendation must contain (1) all information for each director nominee required to be disclosed in a proxy statement by the Securities Exchange Act of 1934, as amended (the Exchange Act); (2) the name and address of the shareholder making the recommendation, and the number of shares owned and the length of ownership; (3) a statement as to whether the director nominee meets the criteria for independence under the rules of the New York Stock Exchange and the Director Independence Guidelines; (4) a description of all arrangements or understandings, and the relationship, between the shareholder and the director nominee, as well as any similar arrangement, understanding or relationship between the director nominee or the shareholder and General Dynamics; and (5) the written consent of each director nominee to serve as a director if elected. The committee will consider and evaluate persons recommended by shareholders in the same manner as it considers and evaluates potential directors identified by the company. The information requirements for director nominations can be found in Article II, Section 10 of our Amended and Restated Bylaws available on our website at www.generaldynamics.com, under the “Investor Relations” – “Highlights” headings, or in print upon request.

2014 Director Nominees. The following 12 nominees are standing for election to the Board of Directors at the Annual Meeting. All nominees are currently serving as directors. If any nominee withdraws or for any reason is unable to serve as a director, your proxy will be voted for any remaining nominees (except as otherwise indicated in your proxy) and any replacement nominee designated by the Nominating and Corporate Governance Committee of the Board of Directors.

MARY T. BARRA | • Chief Executive Officer of General Motors Company since January 2014; Executive Vice President, Global Product Development & Global Purchasing & Supply Chain, August 2013 to January 2014; Senior Vice President, Global Product Development, February 2011 to August 2013; Vice President, Global Human Resources, 2009 to January 2011; Vice President, Global Manufacturing Engineering, 2008 to 2009 • Ms. Barra currently serves as a director of General Motors Company. Key Attributes/Skills/Expertise: Ms. Barra’s business and educational background, including a bachelor’s degree in electrical engineering and a master’s degree in business administration, enables her to provide valuable strategic, operational and business advice to the company. Ms. Barra’s current position with General Motors as chief executive officer, and her former positions as senior vice president, global product development; vice president, global human resources; and vice president, global manufacturing engineering, position her well to advise our businesses on a broad range of matters in the areas of human resources, engineering, manufacturing, and research and development. Her strong and diversified business background provides her with a deep understanding of the challenges and risks facing large public companies with complex global operations. | |

COMMITTEES: Compensation Nominating and Corporate DIRECTOR SINCE2011 AGE:52 |

4 General Dynamics 2014 Proxy Statement

Election of Directors

| NICHOLAS D. CHABRAJA | • Chairman of General Dynamics, June 1997 to May 2010; Chief Executive Officer, June 1997 to July 2009; Vice Chairman, December 1996 to May 1997; Executive Vice President, March 1994 to December 1996 • Mr. Chabraja currently serves as a director of Northern Trust Corporation and as non-executive chairman of Tower International, Inc. Key Attributes/Skills/Expertise: Mr. Chabraja’s 15 years of service as a senior executive officer and 12-year tenure as chairman and chief executive officer of our company make him an experienced and trusted advisor. He has in-depth knowledge of all aspects of General Dynamics and a deep understanding and appreciation of our customers, business operations and approach to risk management. His service at General Dynamics combined with his service on other public company boards provides him with a valuable perspective on governance and management matters that face large public companies. | |

COMMITTEES: Finance and Benefit Plans DIRECTOR SINCE1994 AGE:71 | ||

| JAMES S. CROWN | • Lead Director since May 2010 • President of Henry Crown and Company since 2002; Vice President of Henry Crown and Company, 1985 to 2002 • Mr. Crown currently serves as a director of J.P. Morgan Chase & Co. He served as a director of Sara Lee Corporation within the past five years. Key Attributes/Skills/Expertise: As the longest-serving member of our board and a significant shareholder, Mr. Crown has an abundance of knowledge regarding General Dynamics and our history. As president of Henry Crown and Company, a private investment firm with diversified interests, Mr. Crown has broad experience in general business management and capital deployment strategies. His many years of service as a director of our company and two other large public companies provide him with a deep understanding of the roles and responsibilities of a board of a large public company. | |

COMMITTEES: Audit Compensation Nominating and Corporate DIRECTOR SINCE1987 AGE:60 | ||

| WILLIAM P. FRICKS | • Chairman and Chief Executive Officer of Newport News Shipbuilding Inc., 1997 to 2001; Chief Executive Officer and President of Newport News Shipbuilding Inc., 1995 to 1996 Key Attributes/Skills/Expertise: Mr. Fricks’ senior executive positions at Newport News Shipbuilding Inc., including chairman and chief executive officer, president and chief executive officer, vice president-finance, controller and treasurer, give him critical knowledge of the management, financial, operational and risk management requirements of a large company and a keen understanding of our key customers. In these positions, Mr. Fricks gained extensive experience in dealing with accounting principles and financial reporting, evaluating financial results and the financial reporting process of a large company. Based on this experience, the Board has determined that Mr. Fricks is an Audit Committee Financial Expert. | |

COMMITTEES: Audit Compensation DIRECTOR SINCE2003 AGE:69 |

General Dynamics 2014 Proxy Statement 5

Election of Directors

| PAUL G. KAMINSKI | • Under Secretary of Defense for Acquisition and Technology, U.S. Department of Defense, 1994 to 1997 • Chairman and Chief Executive Officer of Technovation, Inc. (consulting), since 1997 • Senior Partner of Global Technology Partners, LLC (consulting), 1998 to 2010 Key Attributes/Skills/Expertise: Dr. Kaminski’s prior service as the Under Secretary of Defense for Acquisition and Technology provides him with valuable insight into research and development, procurement, acquisition reform and logistics at the U.S. Department of Defense. In addition, Dr. Kaminski’s education and business background in advanced technology, including dual master’s degrees in aeronautics-astronautics and electrical engineering and a doctorate in aeronautics and astronautics, enables him to provide valuable strategic and business advice to our aerospace and defense businesses. | |

COMMITTEES: Compensation Finance and Benefit Plans DIRECTOR SINCE1997 AGE: 71 |

| JOHN M. KEANE | • Retired General, U.S. Army; Vice Chief of Staff of the Army, 1999 to 2003 • President of GSI, LLC (consulting) since 2004 • Managing Director of Keane Advisors, LLC (private equity), 2005 to 2009 • Senior Partner of SCP Partners (private equity), 2009 to 2012 • Chairman of the Institute for the Study of War • Mr. Keane currently serves as a director of MetLife, Inc. He served as a director of Cyalume Technologies Holdings, Inc., and M&F Worldwide Corp., each a former public company, within the past five years. Key Attributes/Skills/Expertise: Prior to retiring from the U.S. Army at the rank of General, Mr. Keane served as Vice Chief of Staff of the Army. As a senior officer, Mr. Keane managed significant operating budgets and addressed complex operational and strategic issues. Mr. Keane’s astute appreciation for the complexities of the U.S. military and the defense industry, combined with his demonstrated leadership and management skills, make him a valuable advisor to our aerospace and defense businesses. Mr. Keane has gained a strong understanding of public company governance and operations through his service on three public company boards. | |

COMMITTEES: Finance and Benefit Plans Nominating and Corporate DIRECTOR SINCE2004 AGE:71 |

| LESTER L. LYLES | • Retired General, U.S. Air Force; Commander, Air Force Materiel Command, 2000 to 2003; Vice Chief of Staff of the Air Force, 1999 to 2000 • Chairman of the Board of United States Automobile Association since November 2012 and Vice Chairman from November 2008 to November 2012 • Mr. Lyles currently serves as a director of KBR, Inc., and Precision Castparts Corp. He served as a director of DPL, Inc., a former public company, within the past five years. Key Attributes/Skills/Expertise: Prior to retiring from the U.S. Air Force at the rank of General, Mr. Lyles served as Commander of the Air Force Materiel Command and Vice Chief of Staff of the U.S. Air Force. In these positions, Mr. Lyles managed significant operating budgets and addressed complex operational issues. The broad knowledge of the U.S. military and the defense industry he attained through these experiences, combined with his engineering and aerospace educational background, enable Mr. Lyles to provide critical strategic and business advice to our aerospace and defense businesses. In addition, Mr. Lyles has gained a thorough understanding of challenges that face public companies through his service on public company boards. | |

COMMITTEES: Audit Nominating and Corporate DIRECTOR SINCE2003 AGE:67 |

6 General Dynamics 2014 Proxy Statement

Election of Directors

| JAMES N. MATTIS | • Retired General, U.S. Marine Corps; Commander, U.S. Central Command, August 2010 to March 2013; Commander, U.S. Joint Forces Command, November 2007 to August 2010; NATO Supreme Allied Commander Transformation, November 2007 to September 2009 Key Attributes/Skills/Expertise: Mr. Mattis had a distinguished career in the U.S. Marine Corps before retiring in 2013. He served as Commander, U.S. Central Command and Commander, U.S. Joint Forces Command as well as NATO Supreme Allied Commander Transformation. Mr. Mattis’ unique perspective and experiences with U.S. and foreign military strategy and operations, including NATO operations, provide him with valuable insight into international and government affairs and the global defense industry. Mr. Mattis’ demonstrated leadership and management skills make him well-equipped to advise on strategic opportunities and risks associated with our aerospace and defense businesses. Appointed to the Board in August 2013, Mr. Mattis was first identified by an independent director and the chairman and was recommended as a director nominee by the Nominating and Corporate Governance Committee. | |

COMMITTEES: Finance and Benefit Plans DIRECTOR SINCE 2013 AGE:62 |

| PHEBE N. NOVAKOVIC | • Chairman and Chief Executive Officer of General Dynamics since January 2013; President and Chief Operating Officer, May 2012 through December 2012; Executive Vice President, Marine Systems, May 2010 to May 2012; Senior Vice President, Planning and Development, 2005 to May 2010; Vice President, Strategic Planning, 2002 to 2005 • Ms. Novakovic currently serves as a director of Abbott Laboratories. Key Attributes/Skills/Expertise: Ms. Novakovic’s service as a senior officer of General Dynamics since 2002 makes her a valuable and trusted advisor. Through her roles as chairman and chief executive officer, president and chief operating officer, and executive vice president, Marine Systems, she has developed a deep understanding of the company’s business operations, growth opportunities, risks and challenges. As senior vice president, planning and development, she gained a strong understanding of our core customers and the global marketplace in which we operate. Ms. Novakovic’s current service as a public company director provides her with a valuable perspective on corporate governance matters and the roles and responsibilities of a public company board. | |

COMMITTEES: None DIRECTOR SINCE 2012 AGE: 56 |

| WILLIAM A. OSBORN | • Chairman of Northern Trust Corporation (multibank holding company), October 1995 to November 2009; Chief Executive Officer of Northern Trust Corporation, 1995 through 2007 and President of Northern Trust Corporation and The Northern Trust Company (banking services), 2003 to 2006 • Mr. Osborn currently serves as a director of Abbott Laboratories and Caterpillar, Inc. He served as a director of Northern Trust Corporation within the past five years. Key Attributes/Skills/Expertise: Mr. Osborn’s prior service as a senior executive of Northern Trust Corporation, including as chairman and chief executive officer, and president and chief operating officer, provides him with extensive knowledge of the complex financial, operational and governance issues of a large public company. He brings to our Board a well-developed awareness of financial strategy, asset management and risk management and a strong understanding of public company governance. The Board has determined that Mr. Osborn’s extensive experience with accounting principles, financial reporting and evaluation of financial results qualifies him as an Audit Committee Financial Expert. | |

COMMITTEES: Audit Compensation Finance and Benefit Plans DIRECTOR SINCE 2009 AGE: 66 |

General Dynamics 2014 Proxy Statement 7

Election of Directors

LAURA J. SCHUMACHER | • Executive Vice President, Business Development, External Affairs and General Counsel of AbbVie Inc. since January 2013 | |

COMMITTEES: Compensation DIRECTOR SINCE2014 AGE: 50 | • Executive Vice President, General Counsel and Secretary of Abbott Laboratories, 2007 to December 2012; Senior Vice President, General Counsel and Corporate Secretary, 2005 to 2007 Key Attributes/Skills/Expertise: Ms. Schumacher’s positions as chief legal officer of two large public companies provide her with extensive experience with respect to risk management and a deep knowledge of the types of legal and regulatory risks facing public companies. Her experience as a senior executive in the healthcare industry has provided her with a keen awareness of strategic considerations and challenges associated with a complex, highly regulated industry. Additionally, through her recent key role in the strategic consideration and execution of the separation of AbbVie from Abbott Laboratories, Ms. Schumacher brings an important understanding of and insight into corporate governance matters and complex corporate transactions. | |

Appointed to the Board in February 2014, Ms. Schumacher was first identified by an independent director and was recommended as a director nominee by the Nominating and Corporate Governance Committee. | ||

| ROBERT WALMSLEY | • Retired Vice Admiral, Royal Navy • Chief of Defence Procurement for the United Kingdom Ministry of Defence, 1996 to 2003 • Senior Advisor to Morgan Stanley & Co. Limited (investment banking), February 2004 to October 2012 • Mr. Walmsley currently serves as a director of Cohort plc and Ultra Electronics plc. Key Attributes/Skills/Expertise: Mr. Walmsley’s prior service as Chief of Defence Procurement for the United Kingdom Ministry of Defence gives him acute comprehension of international defense matters. Moreover, his service as a Vice Admiral in the Royal Navy and his appointments as Controller, Chairman of the Naval Nuclear Technical Safety Panel and Director General, Submarines, provide him with an important perspective on our aerospace and defense businesses. Mr. Walmsley’s service as a public company director in the United States and the United Kingdom positions him well to understand complex operational and governance matters at a large public company. | |

| ||

COMMITTEES: Audit Nominating and Corporate DIRECTOR SINCE2004 AGE:73 |

Director Retirement Policy.The company’s Bylaws provide that no director shall stand for election beyond the age of 75. Additionally, the Bylaws provide that under circumstances of significant benefit to the company, an individual over the age of 72 years may stand for election as director only with the approval of the Nominating and Corporate Governance Committee and a two-thirds vote of the directors then in office. In March 2014, the committee recommended and the Board unanimously requested that Robert Walmsley stand for re-election. The Board took this action in recognition of the continued valuable counsel and insight that Mr. Walmsley provides to the Board with respect to United Kingdom and international defense matters and the complex operational and governance matters of a global public company.

Your Board of Directors unanimously recommends a vote FOR all the director nominees listed above.

8 General Dynamics 2014 Proxy Statement

CommunicationsGOVERNANCEOFTHE COMPANY

OUR COMMITMENTTO STRONG CORPORATE GOVERNANCE

General Dynamics is committed to employing strong corporate governance practices to promote a culture of ethics and integrity that defines how we do business. At the core, we are in business to earn a fair return for our shareholders. To that end, our Board of Directors believes that a commitment to good corporate governance helps us compete more effectively, sustain our success over the long term and enhance shareholder value.

On the recommendation of the Nominating and Corporate Governance Committee, the Board has adopted the General Dynamics Corporate Governance Guidelines to provide a framework for effective governance of the Board and the company. The guidelines establish policies and practices with respect to Board operations and responsibilities, including board structure and composition, director independence, executive and director compensation, succession planning and the receipt of concerns and complaints by the Board. The Board regularly reviews these guidelines and updates them periodically in response to changing regulatory requirements, feedback from shareholders on governance matters and evolving best practices in corporate governance.

The Board believes that its commitment to good governance is demonstrated by key corporate governance practices, including: a majority voting standard for the election of directors coupled with a director resignation policy; an independent lead director; disclosure of corporate political contributions and trade association dues on our website; an industry-leading executive stock ownership policy; a policy prohibiting hedging and pledging by directors and officers; an executive compensation recoupment (clawback) policy; and shareholders’ right to call a special meeting. These and other practices are highlighted on page 2.

As part of our commitment to strong corporate governance practices, we maintain an active and robust ethics program. We have a Standards of Business Ethics and Conduct Handbook that applies to all employees. This handbook, known as the “Blue Book,” has been updated and improved as we have grown and changed over the years. Our ethics program also includes a 24-hour ethics helpline, which employees can access via telephone or online to communicate any business-related ethics concerns, and periodic training on ethics and compliance topics for all employees.

We also have adopted ethics codes specifically applicable to our Board of Directors and our financial professionals. The Code of Conduct for Members of the Board of Directors embodies our Board’s commitment to manage our business in accordance with the highest standards of ethical conduct. The Code of Ethics for Financial Professionals, which supplements the Blue Book, applies to our chief executive officer, chief financial officer, controller and any person performing similar financial functions.

Any amendments to or waivers from the Standards of Business Ethics and Conduct, Code of Ethics for Financial Professionals or Code of Conduct for Members of the Board of Directors on behalf of any of our executive officers, financial professionals or directors will be disclosed on our website.

Our Board comprises independent, accomplished and experienced directors who provide advice and oversight to further the interests of our company and our shareholders. Our Board believes that its organizational structure provides a framework for it to provide independent leadership and engagement while ensuring appropriate insight into the operations and strategic issues of the company.

Chairman. Our Board elects a chairman from among the directors and determines whether to separate or combine the roles of chairman and chief executive officer based on what it believes best serves the needs of the company and its shareholders at any particular time. The Board believes that Ms. Novakovic’s deep understanding of the company’s business, day-to-day operations, growth opportunities, challenges and risk management practices gained through several leadership positions enable her to provide strong and effective leadership to the Board and to ensure that the Board is informed of important issues facing the company. The Board also believes that having a combined role promotes a cohesive, strong and consistent vision and strategy for the company.

General Dynamics 2014 Proxy Statement 9

Governance of the Company

Independent Lead Director. The Board has created the position of a lead director, selected annually by the Board from among the independent directors. Mr. Crown currently serves as lead director. The Board believes the lead director position provides additional independent oversight of senior management and board matters. The selection of a lead director facilitates communication among the directors or between any of them and the chairman. Directors frequently communicate among themselves and directly with the chairman.

The lead director’s authority and responsibilities are as follows:

(1) | acts as chair at board meetings when the chairman is not present, including meetings of the non-management directors; | |

(2) | has the authority to call meetings of the non-management directors; | |

(3) | coordinates activities of the non-management directors and serves as a liaison between the chairman and the non-management directors; | |

(4) | works with the chairman to develop and agree to meeting schedules and agendas, and agree to the nature of the information that will be provided to directors in advance of meetings; | |

(5) | is available for consultation and communication with significant shareholders, when appropriate; and | |

(6) | performs such other duties as the Board may determine from time to time. |